child tax credit september 2021 direct deposit

Discover short videos related to child tax credit deposit pending on TikTok. These individuals may not.

Where Is My September Child Tax Credit 13newsnow Com

Child Tax Credit Norm Elrod.

. 10K Likes 1K Comments. Below is the full Child Tax Credit payment schedule for the rest of this year as outlined by the IRS. We are aware of instances where some individuals have not yet received their September payments although they received payments in July and August.

They will receive their September payment via direct deposit or. Child Tax Credit Payment Schedule for 2021. 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic O.

That translates to 250 per month. Childtaxcredit 2nd monthly Child Tax Credit officially issued August 13 tomorrow. The September child tax credit payment was sent out via direct deposit and USPS on the 15th Credit.

2nd Monthly Child Tax Credit Payment officially issued TOMORROW 81221 August 13 2021 IRS CTC issue day some may have seen a direct deposit earlier this week. That means if a five-year-old turns six in on or before December 31 2021 the parents will receive a total Child Tax Credit of 3000 for the year not 3600. Heres what to know about the child tax credit ahead of Septembers payments.

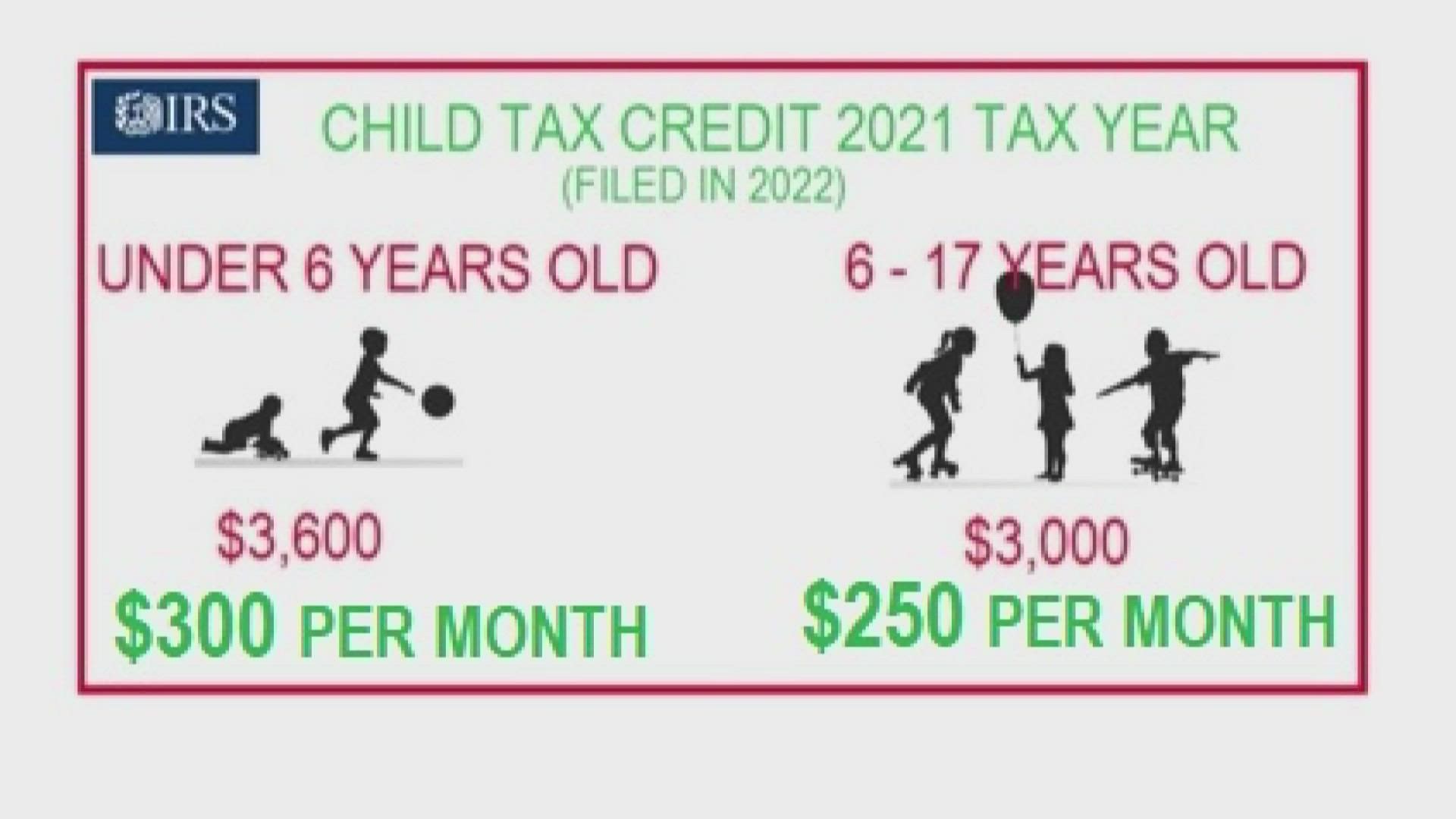

If the payment was a paper check and you have cashed it or if the payment was a direct deposit. That comes out to 300 per month through the end of 2021 and 1800 at tax time next year. The amount changes to 3000 total for each child ages six through 17 or 250 per month and 1500 at.

An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September. The IRS will pay 3600 per child to parents of young children up to age five.

September 17 2021. September 14 2021 at 135 pm. The third payment date is Wednesday September 15 with the IRS sending most of the checks via direct deposit.

Families who requested the payment via paper check should allow up to a week to receive the check via postal mail. IR-2021-201 October 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October. Some Americans voiced frustration on Twitter today when their direct deposits did not post by the morning of September 15.

These updated FAQs were released to the public in Fact Sheet 2022-29PDF May 20 2022. TikTok video from The News Girl lisaremillard. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line.

Watch popular content from the following creators. That changes to 3000 for each child ages six through 17. IR-2021-188 September 15 2021.

Adriyayas_vida Money Smart Mark moneysmart Lovely_arilovelyari36 YTUTAMBIENPUEDESmjbetterbooks The News Girl lisaremillard TheOfficialTai_Youtubetheofficialtai_youtube The News Girl. This third batch of advance monthly payments totaling about 15 billion is reaching about 35. CBS Detroit The third round of Child Tax Credit payments from the Internal Revenue Service IRS goes out this week.

When does the Child Tax Credit arrive in September. Half of the money will come as six monthly payments and. This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion.

The IRS will pay 3600 total per child to parents of children up to five years of age. The IRS will soon allow claimants to adjust their income and custodial.

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit Did Not Come Today Issue Delaying Some Payments 10tv Com

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2021 How To Track September Next Payment Marca

Deadline To Opt Out Of September Child Tax Credit Payment Is Monday Here S How To Cancel It Fingerlakes1 Com

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Parents Are Reporting They Have Not Received Their Child Tax Credit For The Month Here S What May Be Happening

2021 Child Tax Credit Payments Does Your Family Qualify

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal

Child Tax Credit 2021 8 Things You Need To Know District Capital

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Irs Unveils New Feature To Help Avoid Mailing Delays